Sophisticated Strategies for Individual Investors

The Advantages of a Globally diversified portfolio

Our Multi-Asset Program combines the advantages of our core strategies with enhanced diversification through advanced options techniques and active trading in futures markets.

Specifically designed for clients with a minimum investment of $1 million, this program aims to deliver additional returns by adopting a higher-risk approach when compared to traditional stock-and-bond portfolios. Fees for this program are 1.5% of AUM per year.

Multi-Asset Program Structure

asset classes

Options & Futures Strategies

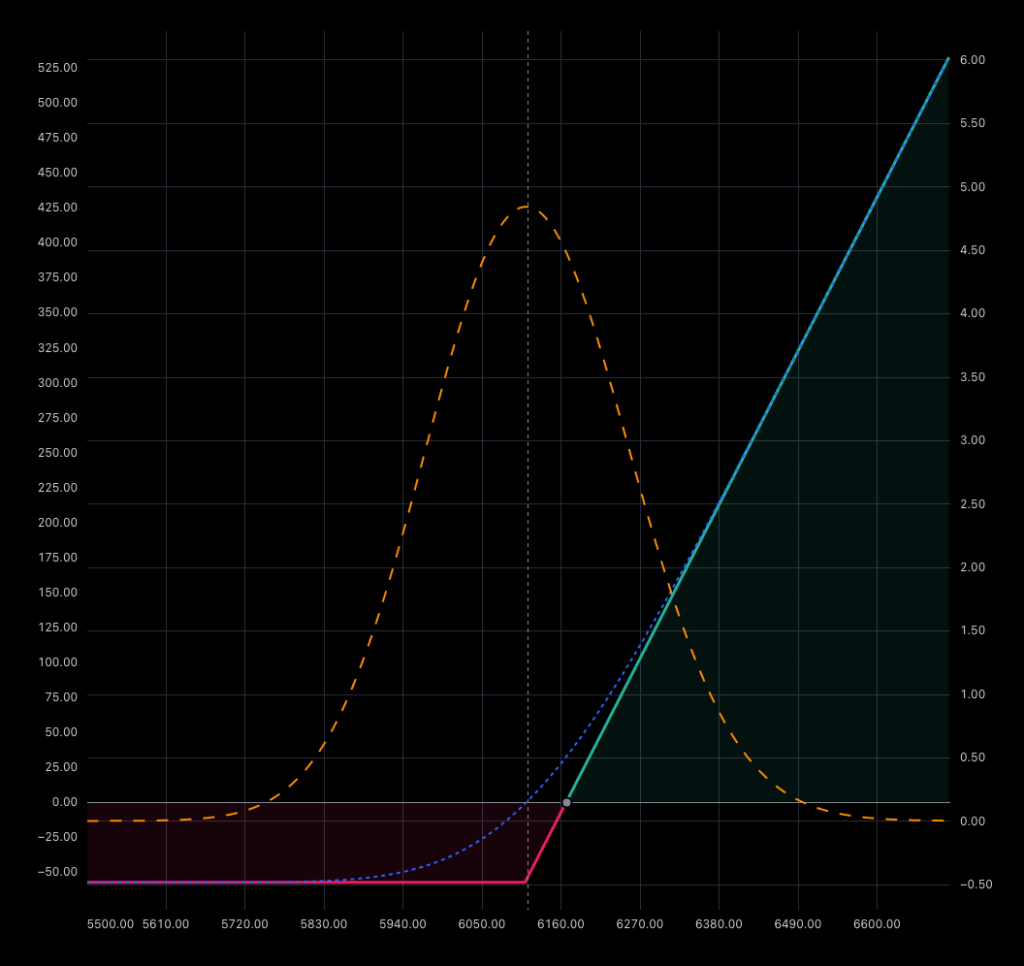

We leverage sophisticated options and futures trading strategies, including hedging, short selling, and automated algorithms, for both short- and long-term opportunities.

fee structure

No Performance Fees

Our strategies offer the best of both worlds: the benefits of advanced diversification – without the performance-based fees that come with it.

account management

Individually Managed Accounts

Each client’s account is maintained separately, ensuring transparency and tailored management. Client assets are never pooled together.

Options Strategies:An Essential Part of a Balanced Portfolio

enhanced market opportunities

Options offer a range of strategic uses that can potentially enhance portfolio returns. Their structure allows us to capitalize on short-term opportunities – without long-term commitments. And they can provide income generation through strategies like covered calls and credit spreads.*

protection against downside risk

Options are also a powerful vehicle for mitigating risk. They can potentially deliver downside protection for investments, provide stability in volatile markets and offset losses in underlying investments.*

cost-efficiency & flexibility

Due to their lower lower capital requirements, options can be a cost-efficient alternative to outright asset purchases. Their flexible structure frees up capital for additional strategies – making them an indispensable tool for investment management.*

* There is no guarantee that the downside protection sought by a buffer or floor will be successful. See our disclaimer for more information.

Managed Futures:

Unlocking the Global Economy

Futures are a powerful tool for diversification within an investment portfolios. By combining them with our other defined outcome strategies, we offer our clients a broader portfolio that is robust, balanced and positioned to capture upside across the global economy.

Access to Broader Markets

Managed Futures gives our clients access to the markets that power the global economy, including energy – oil and natural gas; metals – gold, silver and copper; and agriculture – corn, wheat and soybeans.

Short-Term Opportunities

Designed to capitalize on short-term market movements, our automated trading programs use probability-based models to select upside opportunities while diligently managing downside risk.

Longer-Term Investments

To unlock broader market movements, we aim to combine trend analysis, strategic forecasts and automated trading to capture medium- and long-term market trends.